Everything about Gold Card Visa

Table of ContentsThe Buzz on Gold Card VisaLittle Known Questions About Gold Card Visa.7 Easy Facts About Gold Card Visa DescribedNot known Details About Gold Card Visa The Facts About Gold Card Visa RevealedExcitement About Gold Card VisaA Biased View of Gold Card Visa

Significantly, these estimates only model neighborhood job creation. Such designs are not efficient in determining whether an investment enhances aggregate, nationwide employment. There is little solid, empirical evidence that the EB-5 program as built today creates substantial task development that wouldn't take place without the program. Work creation is absolutely among the main advantages of Foreign Direct Investment (FDI), however when the process takes almost 6 years and still only produces speculative estimates of work creation, it's time to take into consideration options.

Not known Facts About Gold Card Visa

In this instance, the restricting factor on the amount of earnings a Gold Card can generate is the number of candidates ready to pay this dealt with fee. According to estimates from Knight Frank, a property working as a consultant, there are about 1.4 million people living outside the USA with a net worth of at the very least $10 million.

Legislators have previously introduced the REVAMP Act to obtain GSA off the beaten track for tasks setting you back much less than $300,000. But Congress needs to go further and excuse all CBP projects from GSA's testimonial if it determines to make use of the Gold Card Visa earnings for tasks at ports of entrance. Gold Card Visa funding can likewise be utilized to rectify voids in CBP staffing.

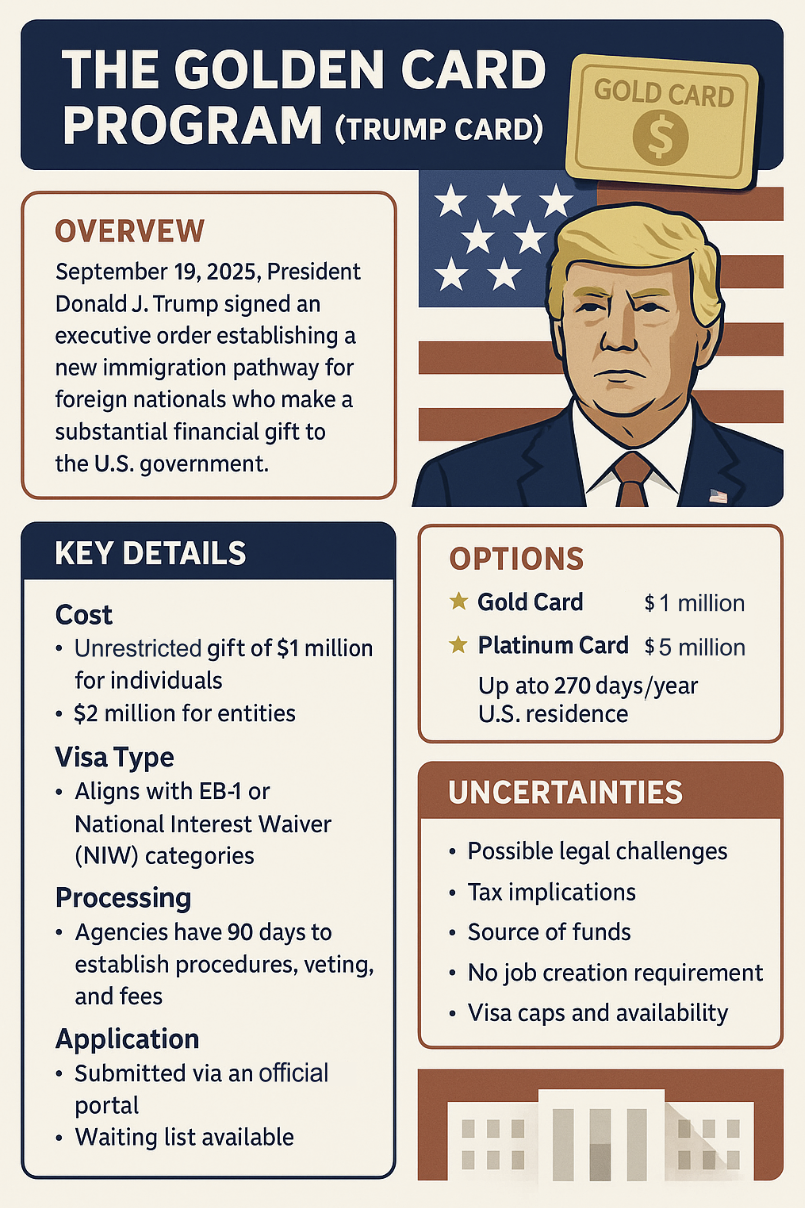

Today, Head Of State Donald J. Trump signed an Exec Order to create the Gold Card visa program, promoting expedited migration for aliens that make significant economic gifts to the United States. The Order directs the Secretary of Business, in coordination with the Secretaries of State and Homeland Safety, to establish a "Gold Card" program.

The 6-Minute Rule for Gold Card Visa

The Order advises that these gifts offer as proof of exceptional company ability and national benefit, quickening adjudication constant with lawful and security issues. The Order routes the Secretary of Business to transfer the presents right into the Treasury and utilize them to advertise business and American market. The Order needs the Secretaries to take all necessary and suitable steps to carry out the Gold Card program, consisting of establishing application processes, costs, and potential growths to various other visa categories.

President Trump is working relentlessly to reverse the tragic plans of the Biden Administration to drive extraordinary financial investments to America. Early in his 2nd term, Head of state Trump recommended Gold Cards, a vision he is now delivering to draw in rich capitalists and entrepreneurs. President Trump's steady dedication to rejuvenating American market has stimulated trillions of bucks in foreign financial investment pledges.

Combined with the simultaneously-issued Presidential Proclamation titled "Restriction on Access of Specific Nonimmigrant Employees" on the H-1B Program needing employers to pay $100,000 per H-1B petition (see Saul Ewing's recap below), there is much speculation concerning the Gold Card Program. While the Gold Card Program has yet to be enacted, several concerns stay taking into account the issuance of the Executive Order.

Some Known Factual Statements About Gold Card Visa

revenue." The Gold Card and the Platinum Card as a result seem designed to run within Congressionally-authorized visa procedures and do not, as anticipated, develop a brand-new visa program that was not formerly authorized by Congress. It is feasible, however, that there will be difficulties to the Gold Card Program raising concerns regarding whether Legislative intent in approving the EB-1 Program and the EB-2 Program is mirrored by the Exec Order.

Another factor that continues to be uncertain is whether individual candidates can include their by-products in the contribution amount; that is, does the needed contribution amount ($1 million for the Gold Card and $5 million for the Platinum Card) apply to only the candidate or instead use to the candidate, as well as the applicant's spouse and any of their children under the age of 21? If the click here former, then a household of 4 would need to donate $4 million for the Gold Card and $20 million for the Platinum Card.

This question will certainly need to be attended to in any last action taken in ordering the Gold Card Program. Another vague subject connects to the vetting that would be carried out under the Gold Card Program. Under the EB-5 Program, each candidate and, much more significantly, each candidate's resource of funds, undergoes an exceptionally detailed forensic analysis.

3 Easy Facts About Gold Card Visa Shown

The IPO would be one of the most logical system to administer the Gold Card Program, provided its experience in providing the EB-5 Program; nevertheless, including the problem of carrying out the Gold Card Program to the IPO would likely reduce adjudications for the EB-5 Program. Another factor to consider associates with the tax treatment for applicants for the Gold Card and the Platinum Card.

on other short-term visa classifications, and who are cautious to prevent conference what is called the "considerable existence" examination. Thus, the effort by the Administration seems to draw in such individuals to purchase the united state by getting a Platinum Card. Nonetheless, just how the tax obligation exemption will be achieved without a modification of the U.S.

Inevitably, it is necessary to take into consideration the Management's purposes in waging the Gold Card Program. Head of state Trump has long mentioned his need to concentrate on modifications to legal migration and to enable investments to lower the national financial obligation. It is also vital to consider that there is global criterion for a two-tier program framework wherein one program concentrates on a "donation system" while another concentrates on an "investment program".

On top of that, yet for the EB-5 Program, thousands of realty developments, both in country and metropolitan locations of the U.S., would certainly not have actually been prompt completed or completed at all. In recap, while the Executive Order stands for a strong and unconventional attempt to straighten migration plan with international contribution to the united state

Gold Card Visa Fundamentals Explained

The new program would function as methods to please the "phenomenal capability" requirements of the present EB-1 and EB-2 visa paths for aliens with remarkable or outstanding ability. Some 80,000 Trump Gold Cards will be offered, according to united state Business Secretary Howard Lutnick. Extra advice is expected, as the EO likewise purchased the Secretary of Commerce, the Assistant of State and the Secretary of Homeland Safety to take all needed and suitable actions to execute the Gold Card within 90 days of the order.

irreversible citizens and residents are presently based on united state taxes and reporting on their worldwide earnings. This suggests that U.S. permanent citizens and citizens need to pay federal revenue tax obligations on income gained outside the United States. The Administration did, nevertheless, likewise hint at a Platinum Card for a $5 million financial payment that would "permit individual applications to stay in the United States for up to 270 days annually without being subject to tax on non-U.S.

people and irreversible residents, as these Platinum Card receivers would be able to spend a majority of their time in the United States without undergoing earnings tax obligations on their international earnings. This program is not yet offered however is reportedly in the works; Lutnick recommended that the program would require congressional authorization before they might officially release the $5 million-per-applicant program.